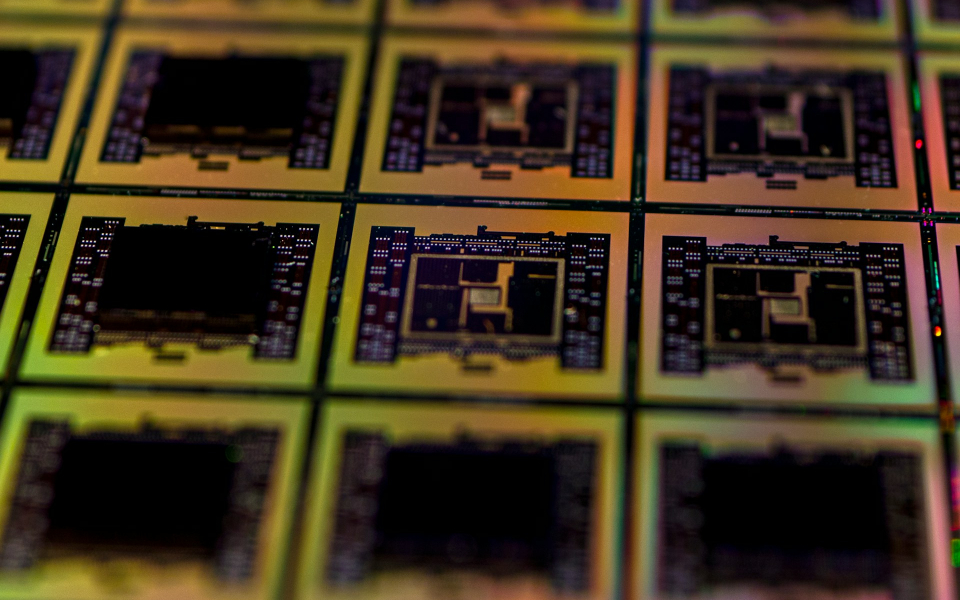

Tiger Global expanded its investment portfolio by acquiring its first stake in the California-based semiconductor manufacturer Broadcom Inc

Simultaneously, Tiger Global aggressively expanded its involvement in the semiconductor industry. Notably, it amplified its holdings in Taiwan Semiconductor Manufacturing Co

The prominent New York hedge fund initiated by American billionaire Chase Coleman III in 2001 strategically adjusted its investment portfolio, significantly impacting its positions in significant technology and semiconductor firms.

Analysts hailed Broadcom as among the biggest beneficiaries of the artificial intelligence frenzy, apart from Nvidia Corp

JP Morgan projects fiscal 2024 revenue and EPS of $50 billion (versus $50.02 billion consensus) and $44.46 (versus $46.49 consensus).

The fund decreased its investments in four of the "Magnificent Seven" tech giants-Alphabet Inc

In contrast, Tiger Global increased its stake in Amazon.com Inc

AVGO Stock Prediction For 2024

When buying a stock for a longer time horizon, it is important for investors to assess where they think the stock is headed in the future.

When mapping a stock's future trajectory, investors should consider factors including the future earnings expectations and expected performance against a benchmark.

Broadcom's revenue has grown at an average rate of 12.38% annually over the past 5 years. The average 1-year price target from analysts is $1180.77, representing an expected -5.87% downside in 2025.

While past performance is not a guarantee of future results, investors should also look at a stock's historical performance when compared to both a benchmark index and the company's peers. Shares of Broadcom have seen an annualized return of 41.03%, outperforming the S&P 500 index by 32.69%. This compares to 17.54% growth in the overall Information Technology sector. Broadcom has a beta of 0.9.

Price Action: AVGO shares traded lower by 0.36% at $1,257.65 on the last check Thursday.