Abbott Laboratories

Fourth-quarter sales increased 1.5% on a reported basis, 2.1% on an organic basis, and 11% on an organic basis excluding COVID-19 testing-related sales.

The company's adjusted earnings were $1.19 a share, matching analysts' expectations.

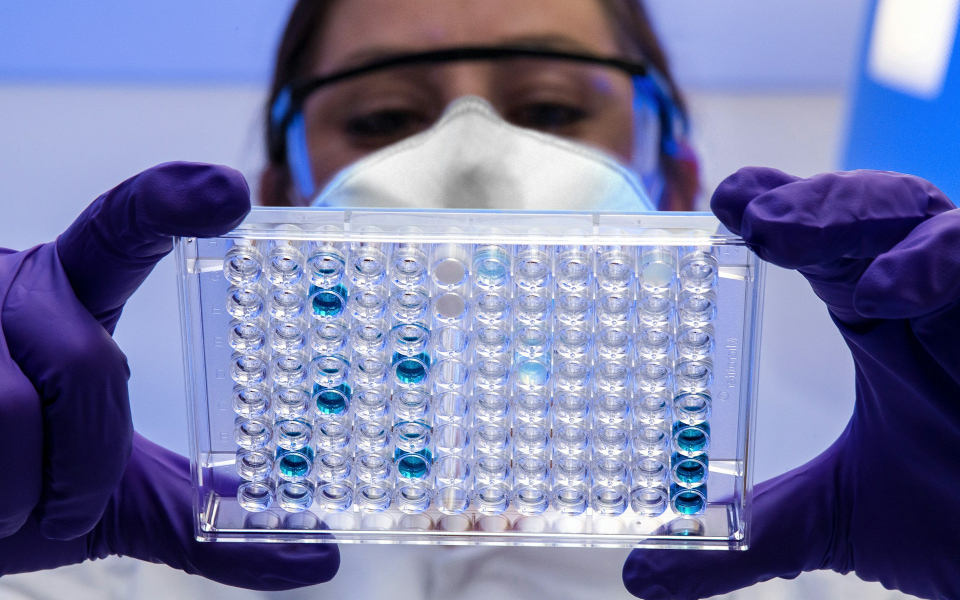

Diagnostics sales growth in the fourth quarter was negatively impacted by year-over-year declines in COVID-19 testing-related sales. Worldwide COVID-19 testing sales were $288 million in the fourth quarter of 2023 compared to $1.069 billion a year ago.

"The strength and diversity of the Abbott portfolio drove our success in 2023," said Robert B. Ford, chairman and chief executive officer of Abbott. "We're entering 2024 with a lot of positive momentum, and with our highly productive pipeline, we're well-positioned for growth in 2024 and beyond."

The company's most significant growth came in the Medical Devices segment, with a sales growth of 17.5% to $4.44 billion.

Within that segment, Diabetes Care grew the most (22%), followed by Electrophysiology (21.5%).

Strong med-tech sales were also partly due to strength of its glucose monitoring device FreeStyle Libre, which brought in sales of $1.4 billion in the fourth quarter, up 25.5% Y/Y.

Last week, Abbott announced that over 30 patients were treated as a part of first global procedures using its new Volt Pulsed Field Ablation System to treat patients battling common abnormal heart rhythms such as atrial fibrillation.

Earlier this month, Abbott and Tandem Diabetes Care Inc

Guidance: For 2024, Abbott forecasts adjusted earnings of $4.50-$4.70 a share, versus the consensus of $4.64.

Abbott projects full-year 2024 organic sales growth, excluding COVID-19 testing-related sales, of 8%-10%.

Price Action: ABT shares are down 3.08% at $110.49 at last check Wednesday.