Two months ago, we reported on the Fed's proposed changes to the Volcker rule. At the time, banks welcomed the news; they had long been hoping for a change to the rule, which was introduced after the 2008 financial crisis to curb proprietary trading at deposit-taking financial institutions, but which many banks found overly restrictive. The Securities Industry and Financial Markets Association, for instance, hailed the Fed's promised overhaul of the Volcker rule as a sign of the "growing recognition by policymakers of the unintended negative impact due to the excessive complexity of the current regulations."

But it seems the Fed's changes haven't appeased the banks. Earlier this August, attorneys from major banks like JPMorgan Chase

The banks are mainly unhappy about one proposed change. The Volcker rule currently says regulators can presume that positions held by trading desks for less than 60 days violate the Volcker rule unless the banks prove that they do not. The Fed's new proposal would alter that standard to cover all available-for-sale securities, and if the absolute daily value of those trades over 90 days exceeded $25 million, the bank would be forced to show that it wasn't speculating for its own account. The banks argue that this is far too burdensome a standard.

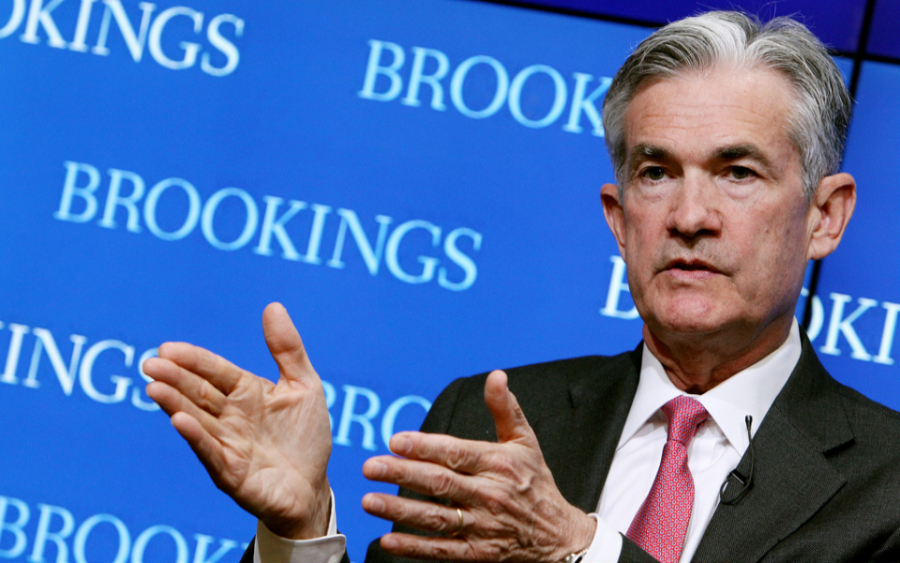

It's unclear if the Fed will address the bank's complaints, though the current Fed leadership and the Trump administration has been fairly friendly to banks. Chairman Jerome Powell has made it a priority to reduce what he calls "overly complex and inefficient" requirements. And back in May Trump took action to cushion the Volcker rule's impact by streamlining the Volcker rule as it applied to medium banks and exempting smaller banks altogether.

- https://www.pws.io/fed-mulls-changes-to-volcker-rules

- https://www.sifma.org/resources/news/sifma-statement-on-proposed-rulemaking-on-the-volcker-rule/?mod=article_inline

- https://www.wsj.com/articles/banks-say-no-thanks-to-volcker-rule-changes-1534353932

- https://www.barrons.com/articles/unleash-the-animal-spirits-fed-moves-to-loosen-the-volcker-rule-1527709288?mod=article_inline